Wednesday, July 12, 2006

Intentional Economics Day 3

I was doing okay with the nightly blogging until the last day. I'm going to finish it up today, though. On Monday, I hiked with a couple from Pittsburgh who also stayed an extra day. Later, I walked down the pedestrian mall to a fantastic used bookstore and picked up four books. I slept the entire flight back to Austin arriving at midnight. Lewis picked me up and on the ride back we talked about a remarkable story Bernard told in the last hour about Francisco de Orellana. Lewis spent some time in the jungles of Brazil in January.

If I had picked up the Sunday New York Times on Day 3, this is what I would have read from Ben Stein:

Is this America, where far too many of the rich endlessly loot their stockholders and kick the employees in the teeth, the America that our soldiers in Ramadi and Kirkuk and Anbar Province and Afghanistan are fighting for?...Are we maintaining an America that is not just a financial neighborhood, but also a brotherhood and a sisterhood worth losing your young husband for? Is this still a community of the heart, or a looting opportunity? Will there even be a free America for Mrs. Wroblewski's descendants, or will we be a colony of the people to whom we have sold our soul? Are we keeping the faith with this young widow? That is the question I ask about this beloved and glorious America for which her husband, Lt. John Thomas Wroblewski, died. If we are, we should be proud. If we are not, we'd better change, and soon.Clearly, we are not keeping the faith, but is Bush to blame? No, Bush is a symptom. Do we need Bush to remind us again that we have to fix the big problems ourselves? Of course, the problems seem impossible using conventional money and conventional economics. The reason? There are two implicit hypotheses in Economics:

1. Money is value neutral

2. Our money system is a given, like the number of planets in the solar system

100% of Economic Theory is built on these two hypotheses. Both of them have been proven wrong.

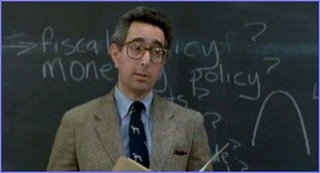

Bernard describes three different problems and currency solutions which show us redesigning systems is more effective than trying to redress symptoms.

The first problem is "how do you solve the problem of unsustainable short-term corporate thinking and reduce a corporation's risk associated with monetary instability?" He describes the Terra.

The second problem is "how do you increase a country's knowledge capital?" Since the best way to learn something is to teach it, the Saber currency is a time dollar (tax exempt) currency which flows from younger students to older students in a mentorship hierarchy.

The third problem is "how do you provide preventative health care measures?" The traditional system provides what it is paid for: to keep sick people alive. Bernard describes a complementary currency system used in Bellingham, Washington.

Bernard tells us that intentional economics always has a time horizon. The time horizon is the length of time you have to disarm your opposition. What's left will be the sacred cows you have to work around. Conventional economics is just intentional economics with a time horizon of zero.

At the end of the day, there was a reception for Bernard who is finishing his visiting professorship at Naropa. It was an emotional goodbye for the people at Naropa. Good folks there. There seems to be a dignity associated with people who live near the mountains.